F&O Strategy

SBI Cards: Bull call spread

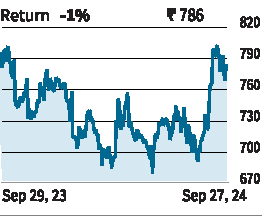

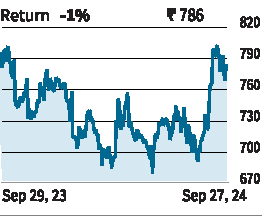

SBI Cards and Payments Services (₹786.30) is ruling at a crucial level. The stock finds resistance at ₹830 and ₹1,010. Supports are at ₹768 and ₹685. The bias is positive to breach the key resistances.

F&O pointers: SBI Cards October futures closed at ₹793.75, a decent premium of about ₹7 over the spot close of ₹786.30. This signals roll over of long positions from September to October series.Option trading indicates a wide range of ₹700-850.

Strategy: Traders can consider a bull-call spread on SBI Cards. This can be initiated by selling 800-call and simultaneously buying the 785-call. These options closed with a premium of₹20.25 and ₹27.40 respectively.

This will entail an outflow of ₹7.15, which would be the maximum loss which will happen if SBI Cards closes at or below ₹785 on expiry.

On the other hand, a profit of ₹7.85 (₹6,280 as the market lot is 800 shares) is possible if SBI Cards hit ₹800. Hold the position till expiry week if the profit is not achieved earlier.

Follow-up: As expected, Titan Industries was volatile last week. After initial hiccups, the stock recovered on a strong note on Friday. However, the recommended position is slightly negative. Hold the position for one more week.

Note: The recommendations are based on technical analysis and F&O positions. There is a risk of loss in trading